Bitcoin (BTC) - Key Support Level Remains Intact

Market Review: Navigating September’s Trends

Last week’s focus was on the US labor market report and its potential impact on Bitcoin and the broader market. The debate remains unresolved, which, in a way, could be a positive sign—if the debate were settled, it might indicate we’re in a precarious situation aiming for a major decline!

For now, the market is relatively stable. Referring to last week’s analysis on Bitcoin, we considered the possibility of reaching $53.5k while maintaining a bullish outlook. The market has hit that level with a notable reaction (particularly on Monday), so we remain cautiously optimistic for the remainder of September.

Key Considerations:

- Support Level: If this $53.5k level turns out to be the low, it aligns perfectly with a retest of the August wick. This level represents a strong buying opportunity while still maintaining a bullish bias.

- Bullish Momentum: A recovery to $58k would signal increased confidence. Although the market may fluctuate around these levels before the FOMC meeting, this is the key level to watch for signs of immediate strength.

- Momentum Ignition: Movement above $70k would indicate a significant shift. While this is a distant target, it’s crucial to monitor if considering swing trades.

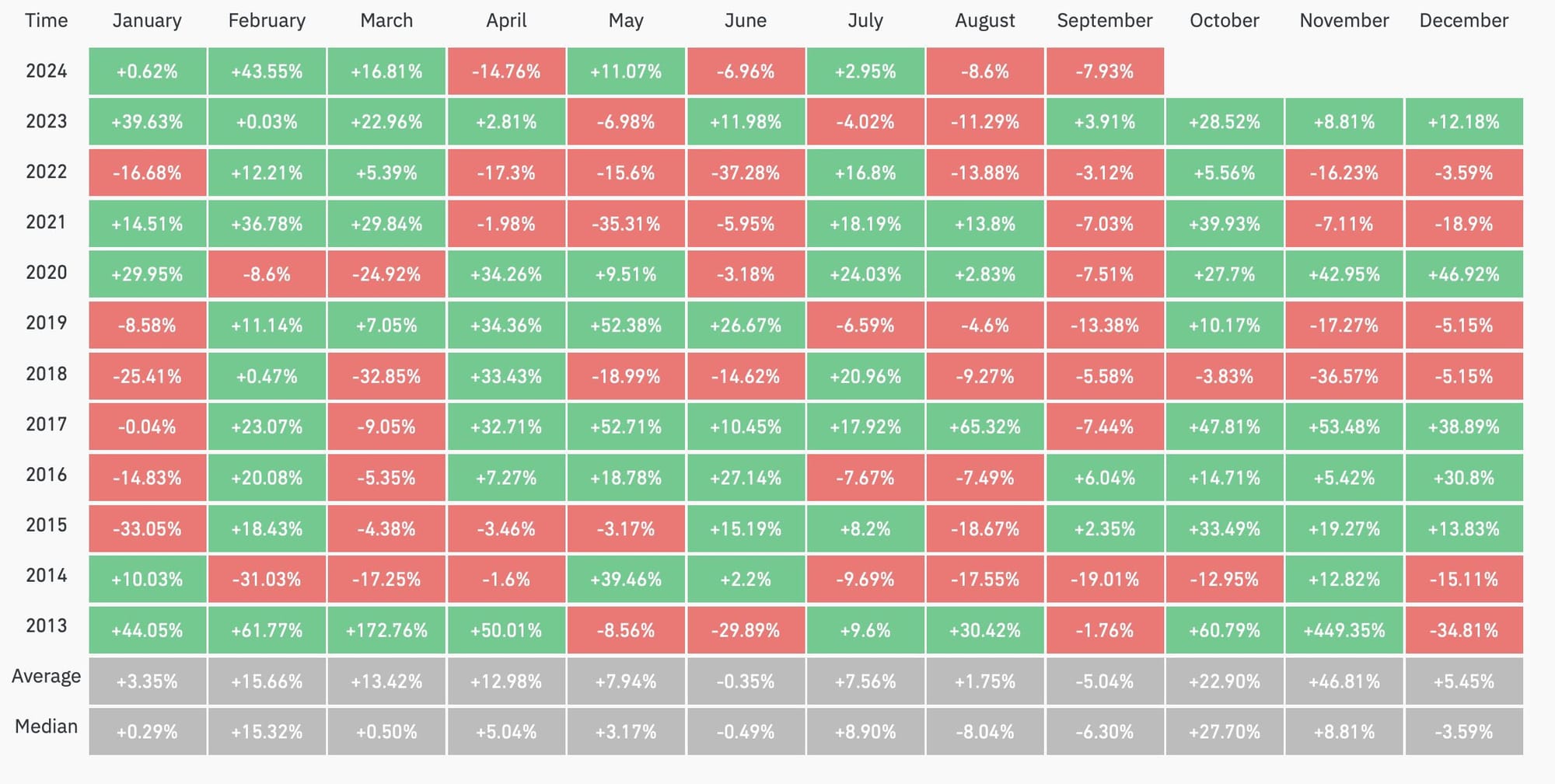

- Consolidation Patterns: Anything below $70k will be viewed as consolidation within consolidation. Expect significant whipsaw moves between $55k and $65k throughout September, which historically tends to be a slow month for markets. Our primary goal is for the price to stay above $53.5k.

Summary:

Keep things straightforward. If you entered at $53.5k, hold your position until either invalidation or new highs are achieved. September tends to be a slow month with Bitcoin’s best performance historically capped at 6%. Manage your expectations accordingly, and as long as the price remains above the key $53.5k level, there’s room for optimism for this final quarter.