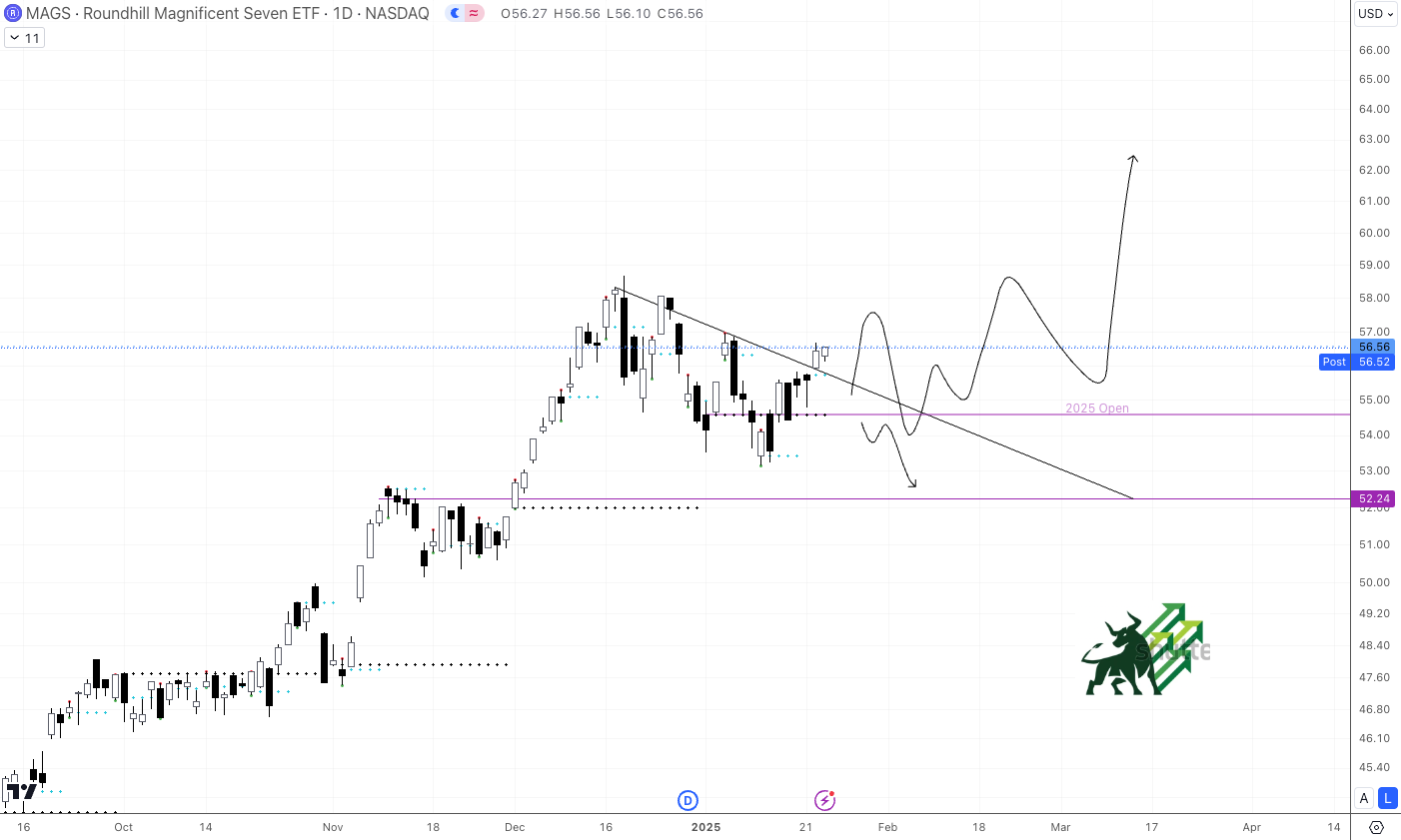

Mag7 Tech Stocks - Edition #26

The tech sector keeps on giving. Roundhill Magnificent Seven ETF $MAGS had a nice bullish reaction above the 2025 yearly open and seems to be breaking the descending resistance trend line. Ideally we want price to close the weekly chart above $57 for further continuation but it is already looking quite good. The $54's price range should act as support.

BUY THE DIP on Tesla $TSLA! Any retrace towards $390 - $380's is a buy. As long as we don't break below the most recent lows price WILL pump. This is a no brainer.

NVIDIA $NVDA +13% in profit from last trade setup. As of now this should be treated as range high and profit must be taken. If we get a strong weekly close above previous all time high then expect further bullish momentum

Alphabet $GOOGL +4% in profit from previous swing trade idea. Similar to NVIDIA, this should be treated as a trading range. Unless we break above previous highs there's not much to be exited about.

Microsoft $MSFT is ON THE MOVE! weekly chart looks quite strong as price just nuked from our buy zone we've been calling for a while now. We need price continuation towards new highs. Time to sit back and relax...

Facebook $META is on the MOVE! Perfect pump from entry and the weekly chart is looking quite good. A strong weekly close above previous highs will give better confluence for further upside nonetheless its ALREADY BULLISH...!

Amazon $AMZN is READY FOR TAKE OFF. Bullish breakout confirmed.

Any retrace toward $230's should be a buy.

The moment of truth on Apple $AAPL as it stands at a critical support level. Price just took liquidity off the lows and must remain above this level for further upside. We are currently standing in the best risk reward level.

Previous report HERE:

Disclaimer

Not financial or tax advice. Zelf Trade is not a financial institution. No content on this Newsletter is financial, accounting, legal or tax advice. Zelf Trade content is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.