SOLANA - EDITION #4

Solana - Navigating the Market Landscape & Adjusting the Strategy

As we reflect on the recent trades, it’s clear that the strategy of buying at the $206 level and holding through price dips has paid off. The market has been dynamic, and although we anticipated a drop to the $180 range (and even a potential dip into the $170s), Solana's resilience in the face of a steady Bitcoin market has been noteworthy. This stability in Bitcoin, combined with the ongoing weakness in the alt market, has played a major role in Solana’s price action.

Looking back at the trade execution, selling at $246 was the right call, even if it wasn’t the easiest decision. Holding through the $206 dips was equally challenging, but with the broader time horizon in mind, buying at a 20% discount was too compelling to pass up. The bounce that quickly followed—taking us back above $280—reinforced the idea that staying patient with the long-term view could offer huge upside potential.

But now, with new price action and key levels to consider, it's time to reassess and update our macro view as we approach Q1 2025.

Monthly View: Bullish Expansion and the Path Forward

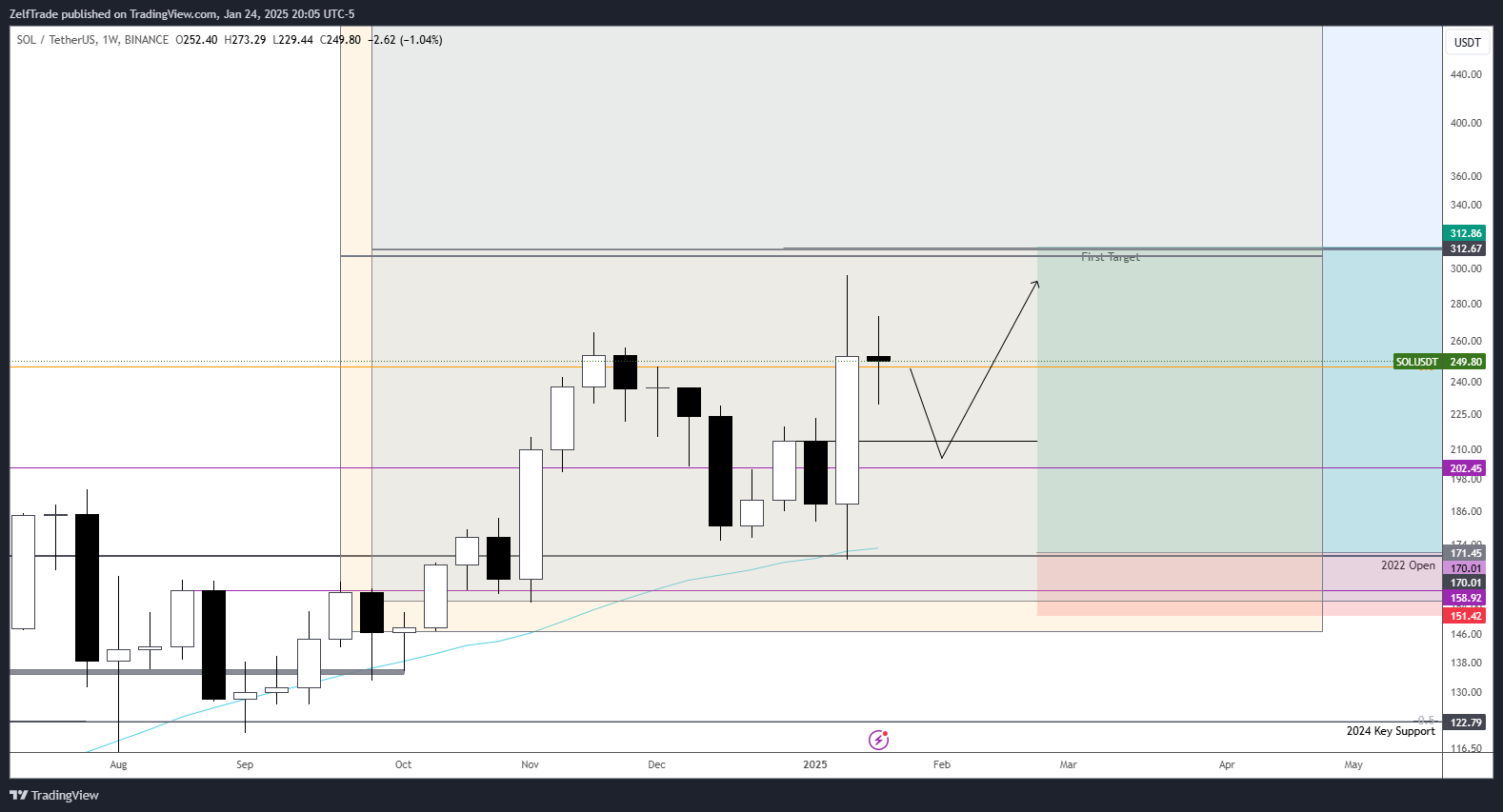

This month’s price action has been strong, especially with Solana taking liquidity from both sides of the inside bar. The dip to the $170 range offered a solid entry, especially with the bullish expansion bar now in place. Historically, after an expansion bar forms, no monthly candle low has been retested since the October 2023 low, which gives us reason to believe that the $170 could indeed be the bottom.

What’s more, if Solana manages to close above the previous all-time high (ATH) on the monthly chart, it would offer even more confidence in the current trend. As long as price stays above December’s high, we could see continuation toward our targets.

The targets remain unchanged for now: $312 and $700 are still on the list before June. However, I’m cautious about setting overly ambitious quarterly targets without more data to back up that claim. We’ll monitor the progress at the $200-240 range and adjust our view accordingly.

Weekly View: Key Levels & Bullish Structure

On the weekly timeframe, the structure still looks bullish, and the demand found in key levels suggests that a retest into the low $200s is unlikely. If we do see this retest, it could activate a deviation play, where additional buys would be welcomed. This scenario could take a few weeks to unfold, but once price breaks out of this zone, expect it to be explosive.

The key takeaway here: $202 is a strong support level, and I don’t expect it to dip lower than that unless the broader market shifts dramatically. However, as we saw previously, the market can always surprise us, and we’ll stay flexible with our risk management.

SOLETH: No Change in Trend, Still Outperforming Ethereum

Solana has continued to outperform Ethereum (ETH), and the recent price action solidifies this. We had anticipated a rotation back into Ethereum, but Solana has proven resilient with a consistent trend and has held the critical support at 0.05 in the SOLETH pairing.

While the rejection at the 0.065-0.07 range didn’t materialize as expected, the trend against Ethereum remains intact. For now, it’s essential to monitor this relationship closely. The signal will expire in February, and while Solana’s performance has been strong, there’s still uncertainty about whether this trend will continue. I’ll update the strategy early in February with more clarity on price objectives and any new trends that emerge.

Conclusion: Staying Flexible and Adjusting as Needed

The macro picture for Solana and its relationship with BTC and ETH remains solid, with new signals forming across multiple timeframes. The performance against USDT has been particularly strong, with price respecting key levels and liquidity being captured on both sides. Solana's broader outlook is positive, and we’ll continue to keep a close watch on the ongoing trends, especially with altcoins like RAY, JUP, and even memes. These assets are proving to be logical plays as the market develops.

As always, we’re playing the long game while staying nimble enough to adjust based on price action. If Solana breaks key levels or shows further strength, we’ll adjust our targets accordingly. In the meantime, hold the course and stay ready for the next move.

Happy trading, and let’s continue to monitor the charts!