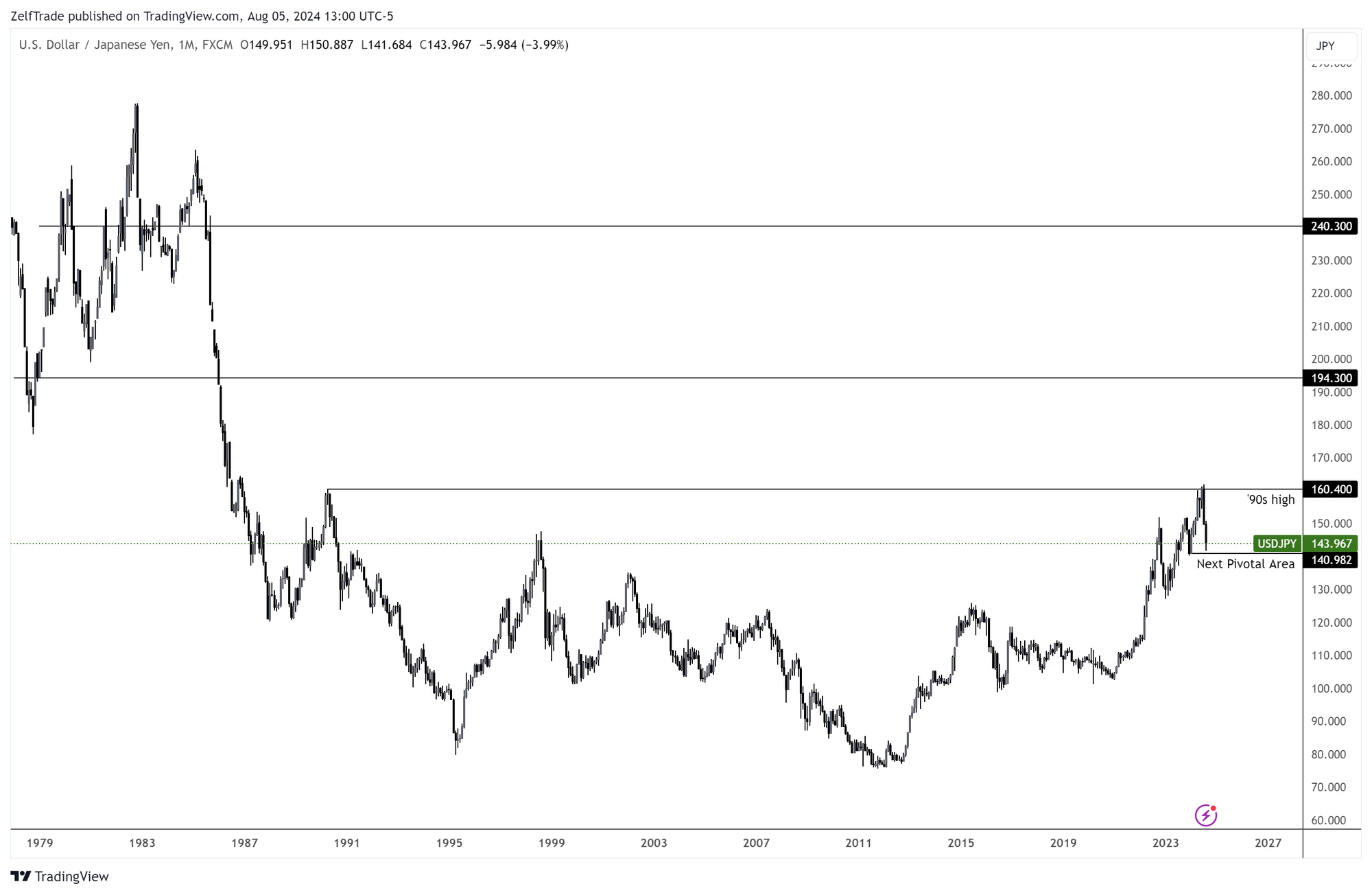

USDJPY - Edition #1

Seismic Market Shakeout!

How many lines have been drawn through this pair before a significant reaction?

Each low has been taken on low time frames, where most would expect some sort of reaction for a good move. This is why one should focus as much as possible on the flow of the market and the type of market rhythm rather than continually pointing out each and every supply and demand level.

Context is everything, you have to respect how the market moves before looking at each S/D zone. One question to ask is, who is in control? As in Bitcoin for example, where the bears maintain their stance protecting each weekly block by rejecting each test. Same goes for USDJPY after failing to gain momentum against the high 90's, last imminent high before a free ascent towards the next cluster zone 193-240. Different pivotal points, but equally important for the bears to protect those zones.

And now, back to the beginning of the year. With only one month of continuous selling and a -12.44% drop, we can say we are looking at a seismic market shakeout!

From a technical point of view

It is in an area where it can turn around and bring us a nice bounce on Tuesday.

Things are looking up after the ISM beat expectations and came in at 51.4 versus 48.8 last month. This solid ISM rise reduces some of the growth fears in the markets. Enough for a rebound? Tuesday will be very telling...

Most of the move is already done. What's left to do? Probably a bounce with a good chance of retracing back to the mid-level of the bearish momentum. Further down the road, we will try to reassess the environment before jumping in with new shorts.

It is unlikely that people will continue to sell here unless it is through forced selling with a continuation of the unwind, so I see a bit of a bounce here before any follow-through towards the December '23 lows. In the meantime, let's focus on the flow rather than the technical aspects of the yen pairs.

Reassess shorts above 150 or below 140.